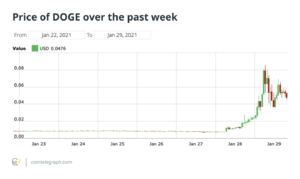

Dogecoin, the quintessential meme crypto, is being pulled on a leash by yet another social media-driven hype.

The current enthusiasm around Dogecoin is not the first social-media-driven hype cycle in the history of the popular meme coin. Indeed, DOGE’s entire existence is built on memetic engineering and the emerging meme economy.

Back in 2020, Tesla CEO Elon Musk tweeted about Dogecoin on two separate occasions, with the token price responding positively in both instances. Last year, Musk came out on top in a Twitter poll to decide who should become the ceo of Dogecoin. The Tesla CEO would later refer to himself as the “former CEO of Dogecoin.”

Musk’s impact on crypto price action is not only restricted to Dogecoin. Bitcoin went on an upward trajectory after Musk updated his Twitter bio to feature only one word: “Bitcoin.”

Just as in the case of Dogecoin back in 2020, Musk flying the Bitcoin flag triggered a massive “Elon candle” for BTC price action. The largest crypto by market capitalization surged by over $5000in only a few minutes, eclipsing the $38,000 mark for the first time since mid-January.

Following Musk’s lead, other notable crypto proponents both within and outside the industry — including participants in the wider tech and social media space — have also begun to fly the Bitcoin banner. Reddit co-founder Alexis Ohanian, a noted Ethererum proponent, has also joined the trend.

Apart from Musk, a viral campaign on the social media platform TikTok also created a significant upward push Dogecoin price action. Indeed, DOGE managed to ride the enthusiasm created by the viral videos to reach a two years high at the time

Asset valuation in the age of social media

The GameStop saga once again put the efficient market hypothesis argument, which says that stock prices are a reflection of fair market value, into stark relief. Indeed, retail traders using publicly available information correctly deduced that mass-buying GME stock would put short-selling hedge funds in trouble.

Under the hypothesis, such a situation — beating the market — can only be achieved by pure luck. However, in the modern age of social media, such concepts are now being increasingly challenged by a horde of irreverent folks who seemingly have an ax to grind with the establishment.

For Aaron Khoo, head of listings at crypto data aggregator CoinMarketCap, the Dogecoin surge is indicative of a much deeper reawakening among retail investors, as he told Cointelegraph:

click here to read more : https://cointelegraph.com/news/bitcoin-price-returns-to-troubled-waters-hours-after-elon-musk-s-btc-tweet

Crazy people