ARK Invest, the American investment management firm led by Cathie Wood, has published a new research report on the various latest trending sectors like Artificial Intelligence, Crypto, EVs, Robotics etc.

The report “Big Ideas 2022” paints quite an optimistic picture for both Bitcoin and Ethereum, predicting that the price of Bitcoin will surpass $1 million by 2030 and that the market cap of Ethereum could exceed $20 trillion.

Earlier this year, predictions of 1 billion crypto users by 2023 were already met with a degree of uncertainty.

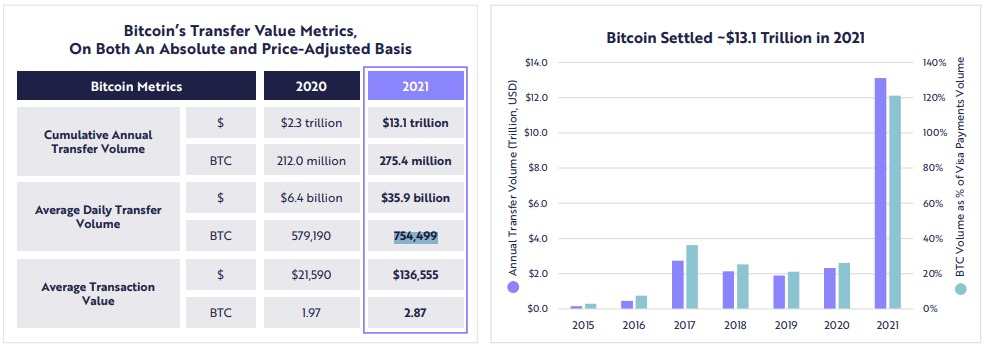

In 2021, Bitcoin’s cumulative transfer volume increased by 463% – going from $2.30 trillion in 2020 to $13.1 trillion USD the following year, which surpasses Via’s $12.1 billion that they settled in the same year. The average daily transfer volume is 754,499 BTC worth $35.9 billion USD

ARK analyst Yassine Elmandjra proposes that Bitcoin is currently still only a fraction of its potential and will scale as it sees more nation-states adopting it as legal tender. Approx. 8% of Bitcoin’s total supply is held by ETPs, corporations, and countries.

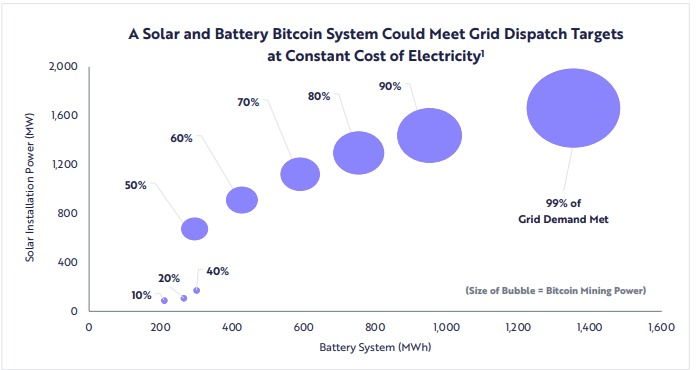

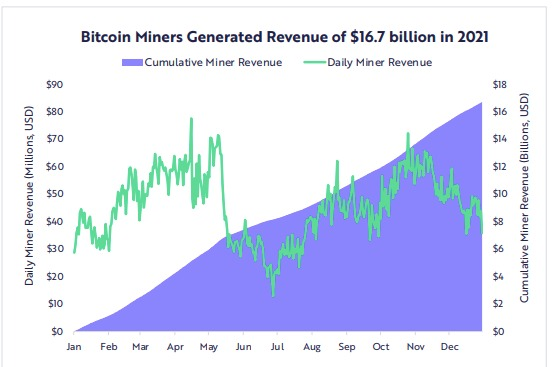

The ARK research suggests that Bitcoin mining could actually benefit the energy industry, the mining may encourage and generate more electricity from renewable carbon-free sources. The mining industry generated a revenue of $16.7 billion in the year 2021 alone.

This is understandably controversial, given that Bitcoin mining machines around the world consume about as much power per year as entire countries.

Ethereum currently has a total supply of approx. 120 million, and after the ETH 2.0, it’ll be expected to burn about a million coins each year – which would put the supply closer to 110 million by the end of the decade. This means that if ARK’s prediction pans out, each ETH would be worth $179,437 USD. That mean that anybody purchasing Ethereum now would make a return of 68X.

ARK makes these several compelling arguments as to why this prediction is justified.

- Ethereum’s potential to displace many traditional financial services and possibly compete as a global currency because of the utility and efficiency that the Ethereum network possesses.

- Ethereum has provided more interoperability, transparency, and financial functionality than ever – with minimal intermediary fees and counterparty risk, and

- Ethereum’s fees have dropped (along with its price), giving more incentive than ever to make transactions with Ethereum.

“Ethereum’s average network fees have dropped to the lowest value in 30 days at 0.0096 ether or $24.64 per transaction,” a Bitcoin.com article says. “Median-sized Ethereum fees are lower today as well, as fees are between $8.37 to $10.82 per transaction as ether fees haven’t been this low since January 1.”

Read More: