Grayscale Investments, the world’s largest digital currency asset manager, announced the launch of Grayscale Solana Trust on Tuesday. The new crypto trust, which will “solely and passively” invest in Solana (SOL), the native token of the Solana blockchain, is Grayscale’s 16th crypto investment product.

The digital asset class is growing, and we’re expanding our offerings along with it! Gain exposure to $SOL, the native token of the @Solana network, through new Grayscale #Solana Trust. Learn more: https://t.co/QiT6u0xI7h pic.twitter.com/KAxRZAriRl

— Grayscale (@Grayscale) November 30, 2021

The Solana network which “a potential long-term rival for Ethereum” is a of project intended to expand blockchain use beyond just a peer-to-peer money system. The Solana blockchain introduced the Proof-of-History (PoH) consensus mechanism as an alternative to pure Proof-of-Stake (PoS) and Proof-of-Work (PoW) blockchains.

The announcement notes:

The trust is now open for daily subscription by eligible individual and institutional accredited investors. The trust functions the same as Grayscale’s other single-asset investment trusts.

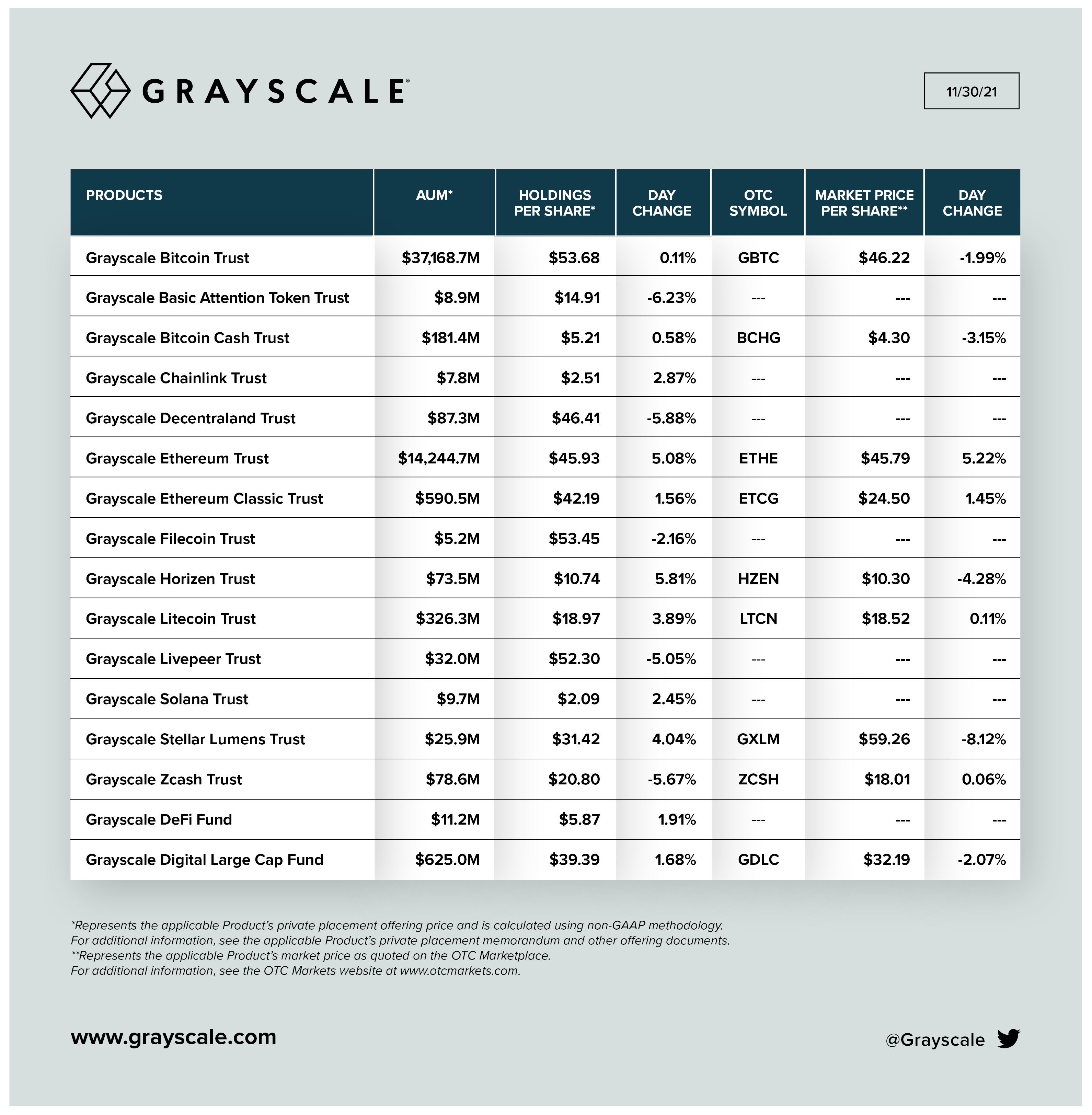

The company reported $53.5 billion in total digital assets under management (AUM) as of December 1. Its most popular is the Bitcoin trust (GBTC) which consist of 69.5 percent, more than $37.2 billion in assets under management, followed by the Ethereum trust (ETHE) with 26.5 percent $14.2 billion.

Through Grayscale family of investment products, it provides access and exposure to the digital currency asset class in the form of a security without the challenges of buying, storing, and safekeeping digital currencies directly.

The list of Grayscale’s investment products include:

Grayscale® Bitcoin Cash Trust

Grayscale® Bitcoin Trust

Grayscale® Digital Large Cap Fund

Grayscale® Ethereum Classic Trust

Grayscale® Ethereum Trust

Grayscale® Filecoin Trust

Grayscale® Decentraland Trust

Grayscale® Basic Attention Token Trust

Grayscale® Chainlink Trust

Grayscale® Zcash Trust

Grayscale® Horizen Trust

Grayscale® Litecoin Trust

Grayscale® Livepeer Trust

Grayscale® Stellar Lumens Trust

Grayscale® Zcash Trust

In addition, Grayscale offers diversified products: Grayscale Digital Large Cap Fund and Grayscale Defi Fund. The former fund provides coverage of the top 70 percent of the crypto market by market capitalization. The latter provides exposure to a selection of industry-leading Decentralized Finance (DeFi) protocols.

Grayscale CEO Michael Sonnenshein commented that for the past eight years: We have had a front row seat to the mainstream acceptance and adoption of crypto, and increasingly find that investors are diversifying their exposure beyond digital assets like Bitcoin and Ethereum.

More Related News:

- Shiba Inu Hits Record by Reaching $2.3 Billion Held on Whale Addresses

- Indian Finance Minister Says Monitoring Crypto Ads; Not Weighing Ban

- MicroStrategy bought another $400M worth of Bitcoin