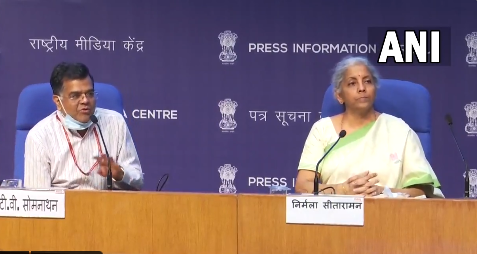

Nirmala Sitharaman, Indian Finance Minister announced the taxation on the crypto and digital assets on Feb 01, 2022. Following the announced Finance Secretary T. V. Somanathan clarified that crypto is not illegal in India. Somanathan said that digital currency will be backed by the Reserve Bank of India (RBI) which will never default.

“Bitcoin, Ethereum or NFT will never become legal tender. Crypto assets are assets whose value will be determined between two people. You can buy gold, diamond, crypto, but that will have not have the value authorization by government,” news agency ANI reported quoting Somanathan.

Govt policy is except agriculture all other income is taxable. Currently,we don't have clarity on cryptocurrency,if it's business income,capital gain or speculative income.Some people declare their crypto assets, some don't. Now uniform rate will be 30% tax: Fin Secy

(File pic) pic.twitter.com/wNp542dtDd

— ANI (@ANI) February 2, 2022

Explaining his point, the Finance Secretary said that people who invest in private crypto should understand that it does not have the authorisation of government and there is no guarantee whether their investment will be successful or not. people may suffer losses and the central is not responsible for the same, he added.

Crypto is a speculative transaction, so we are taxing it at a 30% rate. No one knows the real value of Ethereum. Their rate daily fluctuates. One who earns income through crypto will have to now pay 30%. This is the new policy of the govt: Finance Secretary TV Somanathan

— ANI (@ANI) February 2, 2022

Somanathan said that the digital currency will be backed by RBI, money will be of RBI (Reserve Bank of India) but it will be digital currency popularly known as CBDC (Central Bank Digital Currency). “Digital rupee issued by RBI will be a legal tender. Rest all aren’t legal tender, will not, will never become legal tender,” ANI reported citing Somanathan.

Bitcoin, Ethereum or NFT will never become legal tender. Crypto assets are assets whose value will be determined between two people. You can buy gold, diamond, crypto, but that will have not have the value authorization by govt: Finance Secretary TV Somanathan

— ANI (@ANI) February 2, 2022

Nirmala Sitharaman announced a 30% tax on crypto and other virtual digital assets in her Budget 2022 speech on Tuesday. She said that there has been a phenomenal rise in such transactions and the magnitude and frequency of these transactions have made it imperative to provide for a specific tax regime.

She clarified that no deduction in respect of any expenditure or allowance shall be allowed while computing such income except the cost of acquisition. Additionally, she also proposed a TDS on payment made in relation to the transfer of virtual digital assets at 1% above a monetary threshold.

Read More: